Beauty’s new battleground? AI and data drive skin care tech race

Key takeaways

- Nvidia’s GPU supply is becoming a strategic asset for beauty, as AI factories and personalization depend on computing power.

- AI-powered personalization software can inform portfolio decisions, product gaps, and business strategy, not just consumer routines.

- Futuristic hardware, such as AI-enabled skin sensors, feeds continuous real-world data back into company systems.

Beauty has entered a technology race, and cosmetic companies that do not control their own computing power and data risk becoming dependent on those who do. As AI powers product design, manufacturing, and personalization, brands’ technology infrastructure and data now determine whether they can compete in the race.

AI is increasingly incorporated into all phases of the cosmetics value chain, but it requires powerful graphics processing units (GPUs) to operate at scale. GPUs are high-powered computer chips that process large amounts of data quickly to train and run AI systems. Governments are now competing to secure priority access to these chips to build large-scale AI factories.

Tech giant Nvidia recently pledged an early supply of its Blackwell GB300 GPUs and priority access to its Vera Rubin chips to South Korea. The country’s government and major cosmetic companies have partnered to build large-scale AI factories, and plan to secure up to 260,000 GPUs to realize the vision.

However, the hardware is also necessary to power beauty brands’ own AI tools. Cosmetic companies increasingly use AI to analyze vast datasets and develop hyper-personalized products, while also embedding AI into physical products.

Amorepacific, for example, has debuted wearable skin sensors, and products like AI mirrors are also gaining increased attention. These types of devices generate new streams of data that feed back into AI systems, strengthening companies’ personalization strategies and informing their innovation moves.

According to Nvidia, it’s the demand for personalization that is sending countries and companies flocking to its technology.

“By leveraging Nvidia’s full-stack computing, beauty companies aim to solve the industry’s personalization at scale problem, turning years of complex biological and formulation research into instant, hyper-personalized product recommendations,” Azita Martin, VP and general manager of retail and CPG at Nvidia, tells Personal Care Insights.

However, fulfilling consumers’ demand for personalized products does not rely solely on hardware infrastructure. Anastasia Georgievskaya, co-founder at Haut.AI, explains that early GPU access helps, “but it does not decide winners.”

“The real rush is not toward AI itself, but toward relevance in how skin care decisions are made,” she tells us, advocating for shifting priority to clinically validated datasets.

Nvidia’s GPUs are becoming essential infrastructure for AI development across industries, including beauty.“The companies that win will be those that combine AI infrastructure with scientific validation, explainability, and real-world deployment, not just scale models faster.”

Nvidia’s GPUs are becoming essential infrastructure for AI development across industries, including beauty.“The companies that win will be those that combine AI infrastructure with scientific validation, explainability, and real-world deployment, not just scale models faster.”

Training AI-factories

South Korea’s push for GPU access will directly support the development of AI factories capable of identifying production issues, making independent adjustments, and ensuring consistent output quality without constant human oversight.

Cosmax, the world’s largest cosmetics original design manufacturer (ODM), recently integrated AI across its development, assembly, and packaging stages at its Pyeongtaek 2 factory in South Korea.

According to the company, the facility produces 10.2 cosmetic units per second. Additionally, its color-matching system is said to have reduced development steps from five to three and cut R&D simulation rounds from five to nine.

Cosmax’s factory can produce a wide variety of products, each at a smaller scale than traditional factories can, and faster. This type of manufacturing flexibility is necessary to keep pace with AI-driven product planning systems that can generate new cosmetic products in seconds.

A product planning system, recently unveiled by Kolmar Korea, allows individuals to plan full cosmetic products — from formula to packaging to color ranges — in roughly 30 seconds. Its intention is to enable users to collaborate with ODMs to move from a cosmetic concept to production more quickly.

The platform draws on Kolmar’s accumulated R&D and trend data to recommend optimized formulations aligned with current market demand.

Together, AI-enabled conceptualization and manufacturing create an accelerated loop for cosmetic innovation. However, both hinge on access to hardware and datasets that can inform design choices.

As of early 2026, the global GPU market is experiencing a severe shortage, driven by the sustained demand for AI infrastructure. However, even if companies can access GPUs, Georgievskaya explains that “the real constraint is high-quality, clinically relevant data and domain expertise, not raw compute.”

“Without validated datasets, dermatology knowledge, and strict guardrails, more GPUs simply produce faster noise,” she tells us.

Informing a software edge

When more cosmetic companies solidify their AI infrastructures, Nvidia predicts that differentiation will depend on what they can build on top of it.

.webp) Smart factories now use AI and robotics to produce cosmetic products faster and with greater flexibility.“The differentiators will be fine-tuning of models with their proprietary formulation and research data and omnichannel integration,” Martin says.

Smart factories now use AI and robotics to produce cosmetic products faster and with greater flexibility.“The differentiators will be fine-tuning of models with their proprietary formulation and research data and omnichannel integration,” Martin says.

She explains that most innovative beauty companies are using open-source models to refine their proprietary data. “This allows them to achieve very high accuracy and also own the IP for that model trained with their data, and not usable by other beauty companies.”

L’Oréal and Nvidia partnered last year to develop the French cosmetic giant’s generative AI tool, Beauty Genius. It uses an augmented reality digital advisor to provide personalized beauty guidance to consumers.

Martin says Beauty Genius can answer questions about different product categories and provide personalized diagnostics based on users’ skin type and tone. The tool further recommends beauty routines and product matches from L’Oréal Paris’s portfolio of over 750 items.

“It leverages over 100 years of proprietary skin care research to train its AI models, combined with computer vision to analyze each customer’s skin in real time,” she tells us.

Without the data, Beauty Genius could not exist, and Georgievskaya explains that this is the case for all beauty advisors.

“The Skin.Chat by Haut.AI product, which we released recently, allows brands to establish their own AI-powered conversation on brand-managed digital properties such as web and social.”

Brands can use the tool to guide consumers toward the most suitable products in the brand’s own portfolio, and refine recommendations based on concerns like price or ingredient preferences.

“Beauty is under pressure to deliver personalization with proof, at scale. Consumers no longer accept generic recommendations, and brands are realizing that intuition, marketing claims, or influencer narratives are not enough,” she says.

The tool captures first-party data that reveals whether a brand’s range adequately addresses consumer demand. If shoppers repeatedly search for specific solutions that are missing, it signals a portfolio gap. This way, the AI advisor doubles as a feedback tool for product or marketing decisions.

“AI will … increasingly shape how decisions are made earlier, with more confidence and less friction,” Georgievskaya says.

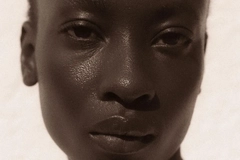

.webp) Amorepacific’s Skinsight uses wearable sensors and AI to track skin data and support personalized skin care.Hardwiring tools

Amorepacific’s Skinsight uses wearable sensors and AI to track skin data and support personalized skin care.Hardwiring tools

Beyond using AI to inform software strategies, companies are increasingly leveraging the technology for physical beauty tools. Wearable sensors and diagnostic devices now embed AI directly into skin care routines.

K-beauty brand Amorepacific unveiled Skinsight earlier this year at CES 2026, and named an Innovation Award Honoree for the product it developed with the Massachusetts Institute of Technology (MIT).

It is a wearable “electronic skin” platform that monitors real-time indicators of skin aging. The system combines an ultra-thin sensor patch, a Bluetooth tool, and an AI-powered mobile app. The trio together tracks micrometer-level changes in skin tightness, temperature, moisture, and UV and blue light exposure over a 24-hour cycle.

AI then analyzes the collected data to identify individual aging triggers, predict wrinkle formation, and recommend personalized skin care routines or products.

“With ultra‑thin electronic skin sensors and AI analysis, we can now track and predict skin changes in real time. This opens the door to efficacy validation driven by real-world data, expanding beyond subjective user evaluations or limited clinical studies,” an Amorepacific spokesperson tells Personal Care Insights.

According to the spokesperson, the diagnostic technologies are used throughout the company’s development process and have already contributed to product development for its key luxury brand, Sulwhasoo.

While AI-driven skin diagnostics and wearable sensors may seem like a science-fiction-level niche in beauty, the spokesperson argues they could become industry standards.

“Advances in semiconductors, sensors, and AI are rapidly creating an environment where highly personalized solutions can be delivered to individuals. Combined with shifting perceptions of data-driven wellness and beauty, digital skin-diagnostic tools are likely to become a common choice,” they tell us.

“Technology is becoming a core driver of sustainable competitive advantage in beauty,” they conclude.