La Roche-Posay enters India with Nykaa partnership, riding premium beauty boom

Key takeaways

- La Roche-Posay is launching in India through retailer Nykaa.

- India’s beauty market is expanding due to rising online spending and disposable income.

- Nykaa’s financial performance and portfolio expansion are strengthening its role in India’s premium beauty segment.

L’Oréal is launching its derma-cosmetics brand La Roche-Posay in India through a partnership with Nykaa, one of the country’s largest beauty retailers.

The launch comes as Nykaa is rapidly strengthening its beauty portfolio amid double-digit revenue growth, tripled profits, and a continued push into premium offerings.

According to Nykaa’s 2025 investor presentation, India is set to become the world’s third-largest economy by the end of the decade. The same report notes that the country’s e-commerce market has expanded from US$25 billion in FY20 to US$60 billion in FY25.

The L’Oréal deal will see Nykaa distribute La Roche-Posay online and in selected brick-and-mortar retail stores across the country.

Nykaa and L’Oréal state that the launch builds on their two-year collaboration, which previously brought CeraVe to India. Both companies expect La Roche-Posay to shape the next stage of medically-informed skin care in the country.

According to Anchit Nayar, executive director and CEO of Nykaa Beauty, the expansion targets a shift in science-based skin care demands in India.

“Indian consumers today are redefining skin care through a lens of science and efficacy. At Nykaa, we’ve witnessed this evolution first-hand, a growing appetite for dermatologist-trusted, clinically validated solutions that deliver real results. The debut of La Roche-Posay in India represents a pivotal moment in this journey,” he says.

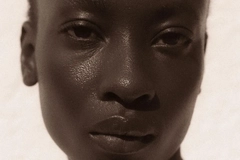

.webp) Rising demand for science-based skin care is reshaping India’s beauty routines.Economic acceleration fuels beauty

Rising demand for science-based skin care is reshaping India’s beauty routines.Economic acceleration fuels beauty

India is entering a period of rapid economic and digital expansion, creating strong conditions for beauty brands to grow.

According to Nykaa’s sources, rising disposable incomes are reshaping consumer behavior, with India’s GDP per capita growing faster than China and the US.

This spending power is flowing into India’s online marketplace. The e-commerce sector has grown from US$25 billion in FY20 to US$60 billion in FY25. Nykaa attributes the increased online traffic to a young, digitally active population.

Beauty and fashion now make up 35% of India’s online purchases. Nykaa’s report projects that India’s online beauty market is forecast to triple, moving from US$5 billion in FY25 to US$14–15 billion by the end of the decade.

The country has an online shopper base of 270–280 million people in FY25, and the figure is expected to surpass 400 million by 2030.

India’s premium beauty market was valued at US$800 million in 2023 and is expected to reach US$4 billion by 2035. The growth is attracting global brands and accelerating competition across online and offline channels — and the La Roche-Posay debut reflects this momentum.

Meanwhile, Nykaa reported a profit of ₹344.4 million (US$3.92 million) for Q2, FY2026 — more than triple last year’s figure. Its beauty business’ revenue rose 25% to ₹21.32 billion (US$242.6 million).

Amid this demand, the retailer added Kylie Cosmetics to its in-store and e-commerce offerings last week. The rollout follows strong consumer adoption and more than 100% growth in India since the brand’s entry in 2024.

.webp) Premium beauty spending is increasing as Indian consumers trade up.Scaling under scrutiny

Premium beauty spending is increasing as Indian consumers trade up.Scaling under scrutiny

L’Oréal’s La Roche-Posay expansion also builds on earlier announcements that L’Oréal would increase its investment in the region, as it touts the country as one of its fastest-growing markets.

CEO Nicolas Hieronimus said in June that L’Oréal plans to more than double its business in India over the next few years. He noted that 95% of the products L’Oréal sells in India are already manufactured locally, and the company aims to increase production for export across the region.

L’Oréal is currently facing scrutiny in the US due to a class action lawsuit alleging that one of La Roche-Posay’s sunscreens, Anthelios Melt-In-Milk, delivers a lower SPF value than advertised.

Despite the controversy, L’Oréal India states that La Roche-Posay has been the largest contributor to L’Oréal’s Dermatological Beauty division globally. The brand generated €2.9 billion (US$3.35 billion) in net sales in 2024, and LÓréal is eyeing a steeper €3 billion (US$3.47 billion) for this year.